Demystifying Agile Marketing for Financial Services

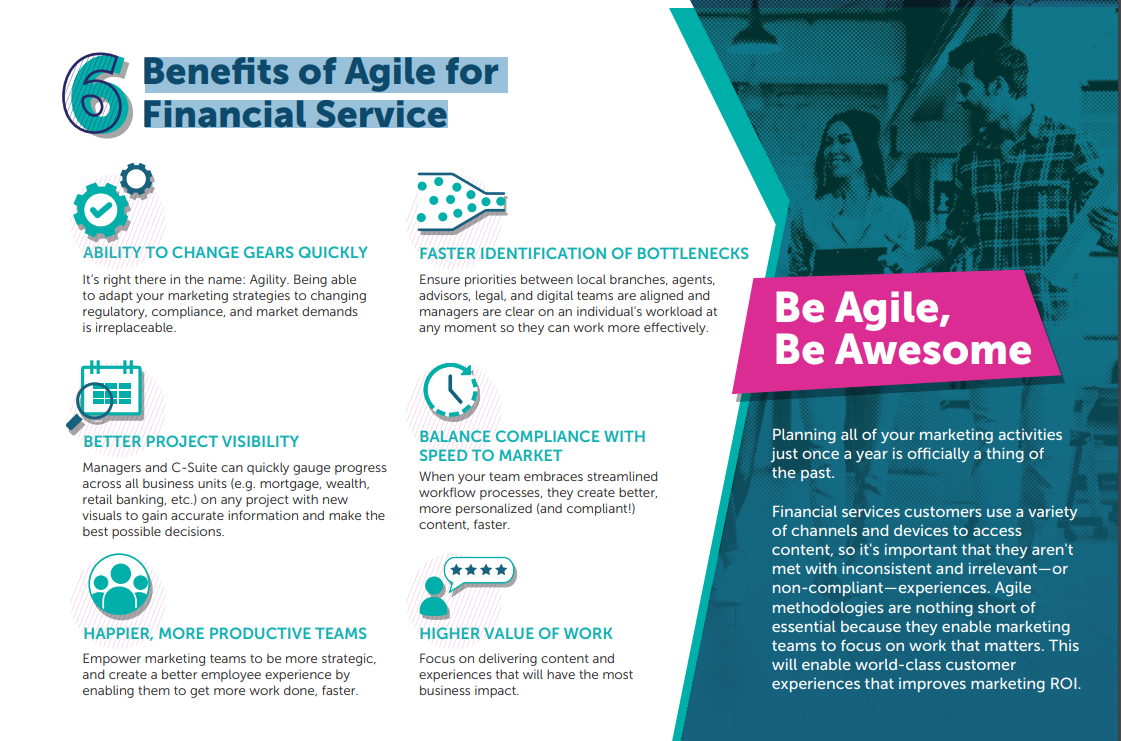

The last ten years have brought more customer demands, new buyers, investors, increased competition, and evolving regulatory needs. Marketers are also challenged with the ever-increasing supply of new channels that they need to be present in all day, every day. And it’s even more challenging for marketers in the financial services industry.

Creating a continuous, positive brand experience is, consequently, more important than ever and more difficult to achieve. And this is all amidst falling marketing budgets and rising pressure to succeed. Agile is how financial services marketing teams can meet all of those challenges.

Agile = Adaptable

WHAT is Agile?

“Agile” describes marketing strategies and methodologies that make teams nimbler, action-oriented, and focused on learning through experimentation. Agile also empowers marketers to prioritize work and focus on work that matters–elevating the role of marketing from cost center to value driver.

Simply put, Agile is a better, smarter way to work in the age of digital transformation.

WHY is Agile Important?

Agile methodologies enable financial services marketers to better prioritize critical work, take on a value-driven mindset, work and collaborate across functions, and respond to rapidly changing situations in every marketing channel. The ability to respond in near real-time to customer concerns, to questions, to product issues, is essential to providing the experience that your customers have come to expect.

Agile methodologies and capabilities are the most effective ways to deliver consistent, speedy, impactful customer experiences that keep up with increasing customer demands across touchpoints.

HOW will Agile Change My Work?

First and foremost, Agile will empower marketers in financial services to take on a more value-driven mindset. It enables marketers to prioritize strategic campaigns and content, and get those experiences to market faster than ever before (while still being compliant!).

Your work could change quite a bit with Agile capabilities in the mix, but how much depends entirely on your business and the capabilities you’re using. Most companies, in fact, follow something of a hybrid approach or a “BYOA” (bring-your-own-Agile) approach, which focuses on the general principles of Agile (quick planning and prioritization, value-driven marketing goals, and nimble ways of work) rather than the full methodology. This is especially true for financial services firms, given their regulatory and compliance requirements.

Some Helpful Terms

Here are some Agile terms and brief explanations to help you understand, at a glance, how Agile could change your team’s workflow.

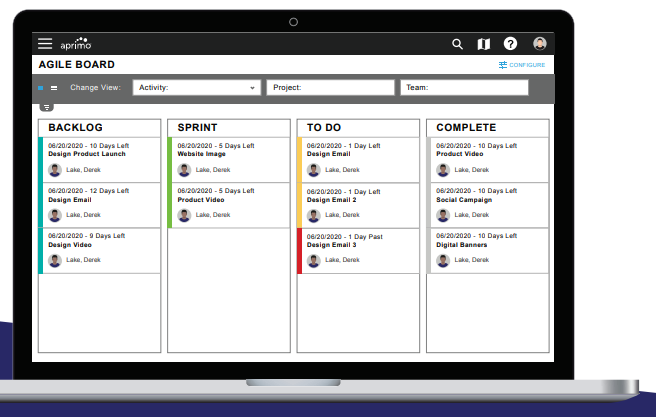

AGILE BOARDS

An intuitive way to visualize your work, including what's in progress, what's done, and what is still to come.

BURNDOWN

How effectively your team clears work to make space for what’s coming next.

BACKLOG SCRUBBING

Constantly evaluate historical tasks to make sure nothing slips through the cracks.

SPRINT

A smaller, more malleable marketing plan— typically 1-4 weeks in length—that makes it easier to deliver outputs.

SPRINT REVIEW

Bring your team together after a sprint to discuss what worked or what didn't as a standard operating procedure.

MINIMALLY VIABLE PRODUCT (MVP)

Quickly deliver smaller outputs that drive immediate value and enable market feedback, while staying disciplined to continuously add and improve the project to completion over time.

Want More Information?

Get in touch, we would love to spend some time talking about your needs and showing how voolama can provide value.

Contact Us